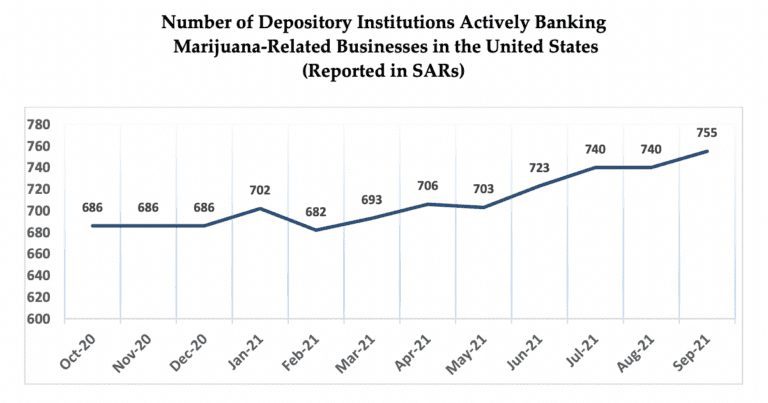

The number of banks that report working with cannabis businesses increased again in Q4 of 2021, according to newly released federal data.

It’s not clear if increasing state marijuana legalization, positive congressional sentiments or moves on the SAFE BANKING act are the reasons. However, the figures from the Financial Crimes Enforcement Network (FinCEN) show that financial institutions continue to feel more comfortable servicing businesses in state-legal markets.

As of September 30, 2021, there were 755 banks and credit unions that had filed requisite reports saying they were actively serving cannabis clients. Thats up from 706 in the previous quarter and from a previous peak of 747 in late 2019.

“Short-term declines in the number of depository institutions actively providing banking services to marijuana-related businesses (MRBs) may be explained by filers exceeding the 90 day follow-on Suspicious Activity Report (SAR) filing timeframe.”FinCEN

Our opinion – This will help reform federal banking laws for marijuana business

Dispensaries have long been targets for criminal gangs using them as “ATMs” by robbing them of their cash at gun point. This happens mainly because dispensaries are forced to keep cash on hand because they can’t legal store it in a bank. The fact that data shows that more banks are willing to work with marijuana business that operate in states where marijuana is legal is a great sign for the industry. More needs to be done here but this is a good sign and will help push federal banking reform laws.

Check out the full article on Marijuana Movement