California’s position as the world’s largest legal cannabis market provides valuable insights into consumer behavior, market dynamics, and the long-term effects of legalization policies. With over 39 million residents and a cannabis industry generating billions in annual revenue, California serves as a crucial case study for understanding how legal cannabis markets develop and mature over time.

Key Statistics:

- 37% of Californians consumed cannabis within the past three months

- California’s legal cannabis market generated $5.2 billion in sales in 2021

- The state has over 1,000 licensed cannabis retailers

- Cannabis tax revenue in California reached $1.3 billion in fiscal year 2021-22

- 75% of California municipalities prohibit cannabis businesses

California Cannabis Consumer Demographics and Usage Patterns

The finding that 37% of Californians have consumed cannabis within the past three months reflects the normalization of cannabis use in a mature legal market. This usage rate is significantly higher than national averages and suggests that legalization has indeed increased access and reduced stigma associated with cannabis consumption. However, it’s important to contextualize this data within California’s unique cultural, economic, and regulatory environment.

California has a long history of cannabis tolerance that predates formal legalization. The state was the first to legalize medical marijuana in 1996 with Proposition 215, creating nearly two decades of quasi-legal cannabis culture before adult-use legalization in 2016. This extended period of medical cannabis access helped normalize cannabis use and established infrastructure that facilitated the transition to adult-use markets.

Geographic Variations in California Cannabis Markets

The demographic breakdown of cannabis consumers in California reveals important patterns about who uses cannabis and how. Younger adults typically show higher usage rates, but California’s data suggests significant consumption across age groups, including growing acceptance among older demographics. This age distribution has important implications for product development, marketing strategies, and public education efforts.

Geographic variations within California also influence consumption patterns. Urban areas like Los Angeles, San Francisco, and San Diego typically show higher usage rates and greater product diversity compared to rural regions. These differences reflect varying local regulations, cultural attitudes, and access to retail locations. Some counties and municipalities have opted out of allowing cannabis businesses, creating “cannabis deserts” where legal access remains limited.

California Cannabis Product Innovation and Market Trends

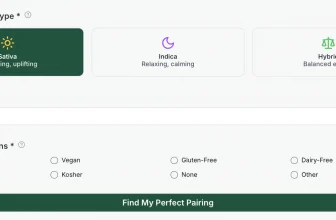

Product preferences among California consumers have evolved significantly since legalization. While flower remains the most popular product category, concentrates, edibles, and other processed products have gained substantial market share. This diversification reflects both consumer sophistication and industry innovation in developing new product formats and consumption methods.

The California cannabis market has also revealed important insights about pricing dynamics and consumer behavior. Legal cannabis prices have generally decreased over time as the market has matured and supply has increased. However, legal products often remain more expensive than illicit alternatives due to taxation and regulatory compliance costs. This price differential continues to support illegal markets, particularly among price-sensitive consumers.

Quality and safety considerations have become increasingly important to California cannabis consumers. State-mandated testing requirements ensure that legal products are screened for pesticides, heavy metals, microbials, and potency. These quality assurances provide value to consumers but also contribute to higher prices compared to untested illegal products.

Cannabis Tourism and Economic Impact in California

The social consumption landscape in California continues to evolve as local jurisdictions grapple with where and how cannabis can be consumed publicly. While private consumption is widely legal, public consumption options remain limited, affecting how and when people use cannabis products. This regulatory gap has created opportunities for businesses to develop consumption lounges and social venues, though local approval processes often remain complex.

Cannabis tourism has emerged as a significant economic factor in California, with visitors from prohibition states contributing substantially to market demand. Cities like San Francisco, Los Angeles, and San Diego have developed cannabis tourism infrastructure, including dispensary tours, consumption events, and cannabis-friendly accommodations.

The integration of cannabis into California’s broader economy has created new business models and partnerships. Cannabis companies increasingly collaborate with traditional businesses in areas like technology, agriculture, finance, and retail. This mainstream integration reflects the industry’s growing legitimacy and economic importance.

California Cannabis Regulation and Tax Policy Challenges

Workplace policies regarding cannabis use remain complex in California, despite legalization. While employers generally cannot discriminate against off-duty medical cannabis use, policies regarding recreational use vary significantly. This regulatory uncertainty affects consumer behavior and employment decisions for many Californians.

The environmental implications of large-scale cannabis cultivation in California have become increasingly apparent. Water usage, energy consumption, and pesticide use in cannabis production have prompted discussions about sustainable cultivation practices and environmental regulations. These considerations influence both regulatory policies and consumer preferences for environmentally responsible products.

California’s cannabis tax structure has generated significant revenue for state and local governments but has also created challenges for industry development. High tax rates contribute to the price differential between legal and illegal products, potentially limiting legal market growth. Ongoing discussions about tax policy optimization aim to balance revenue generation with market development goals.